Friday, December 26th 2014

Hello everybody, it has been a while since I last posted my trades on this blog. I have been busy the last few months and there’s really no “analysis” to do when my bot is the one executing trades. No worries, though, we will be back in January with our daily dose of trades and technical analysis!

Thank you so much for everyone who followed the blog and all the readers. It was a fun experience trying to set this blog up. I’m still learning everyday how to put up an interesting, thoughtful, and useful analysis & commentaries about the global market.

Having said that, I want to post a short post reflecting 2014 and what 2015 will bring. Enjoy!

Rearview Mirror

2014 was a year of dichotomy. Continuing US recovery vs Eurozone recession, All-time-high in equity vs Freefall in commodities, End of Fed’s monetary expansion vs BOJ doubling down on easing.

Here are some interesting highlights of 2014 in no particular order:

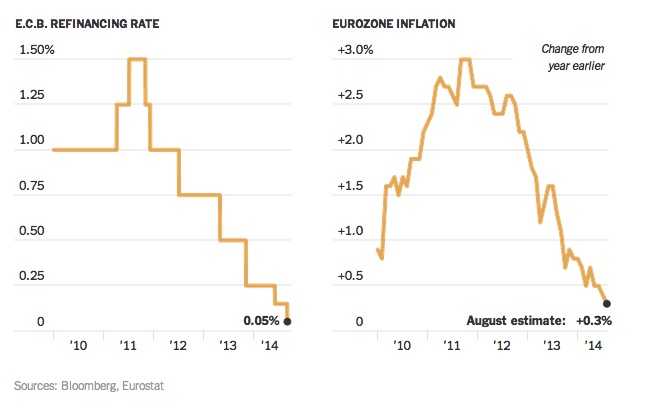

- Draghi was cutting with full force but until a real fiscal unity happens, their asset purchase program is toothless.

- Jobs number in the US looked great but the internals are worrying.

- Republicans took control both Congress.

- Scotland stayed in the UK.

- Eurozone (still) looked fragile.

- US Congress passed a last minute to roll back Dodd-Frank bill restricting prop trading with customers’ money. Jamie Dimon was whipping the votes. Back to pre-2008 we come.

- US Dollar is very… very strong.

- Gold crashed.

- Oil crashed. Brought Russia along with them. Thanks to Saudis!

- S&P 500 all time high! Wealth effect!!!

- Federal Reserve ended its QE program.

- BOJ doubled down on their QE to an unprecedented amount.

Looking Ahead

What will be the most interesting event in 2015? I believe the most obvious answer is oil. When (not if) will the oil price start to rise again? When will the Saudis finally feel the effect of depressed oil price? How will the US shale producers react? What will Putin do? These questions will be answered throughout 2015 and I am really curious to see how it unfolds.

What’s next for gold? Will it rebound? Will S&P500 finally correct? I am not even going to comment on these questions as I have been proven wrong time and time again about S&P 500. However, with the QE program finally ended, will the flow of money to equity finally stopped?

On the political theatre, Obama vs Republicans. Will there be a budget standoffs threatening the credit worthiness of United States in 2015? It is possible. Obama seemed very belligerent after Republicans sweeping victory in the midterms. He started to take initiatives on net neutrality and immigration and this might not bode well with the newly powerful Republicans in 2015.

US Dollar has been on a roll in 2014. Can it sustain the momentum? I am inclined to say it will not but we’ll have to wait and see.

Eurozone has been fairly quiet last year but will it stay that way? Is Greece going to have another crisis? If so, will Draghi able to calm the market?

2015 will be a very interesting year as traders. I hope we can profit and learn a great deal next year. Meanwhile, enjoy the festivities and your loved ones.

Happy Trading and Happy Holidays. See you bright and early in 2015!