Thursday, September 4th 2014

What can I say, Super Mario Draghi pulled no punches today and ECB cut the Eurozone interest rate to 0.05% from 0.15%. Eurodollar fell sharply. He even announced the QE program similar to what Fed is doing here in the US. Let’s go over our trade first and then I want to give some commentary regarding this rate decision.

Trade #1 – Short EUR/USD at 1.30923

Eurodollar breached pivot downwards around 6am ET but knowing the ECB rate decision is around the corner, I decided to be cautious and place a short trade below the trading level so it will only get picked up when there’s momentum downward. This is always a good strategy when there’s a big news coming up and you are unsure where the market will head next. I’ve been trading this way for major decision such as central banks monetary announcement, US Nonfarm payroll, or GDP numbers.

That said, Euro was absolutely clobbered across the board after the rate cut. Went down a cool 200 something pips during the day. Closed my trade for about +145 pips profits as shown with the green check mark.

The “Japan-ization” of Eurozone

This rate decision by ECB is clearly a surprise and the market did not expect such cut, however, it is always important to keep in mind that central banks need to keep their credibility at all cost. This move by ECB, while small, signaled intent that their 2% inflation target is real and they will do whatever it takes to achieve such inflation target. Draghi mentioned:

“The newly decided measures, together with the targeted longer-term refinancing operations which will be conducted in two weeks, will have a sizeable impact on our balance sheet“

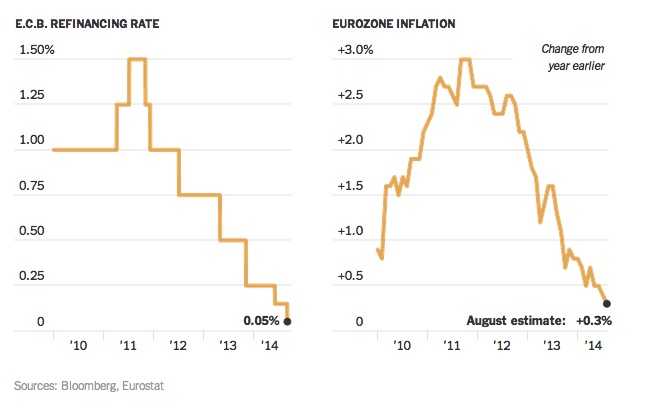

which is clearly a direct jab to market participants who are doubting his resolve to grow the balance sheet. Unfortunately, despite their talks, Eurozone inflation has actually been going down since 2012 as shown by chart below (courtesy of NYT):

In addition to the rate cut, Draghi also announced that starting next month, the ECB will begin buying asset backed securities such as packaged home and business loans, credit card debt, and covered bonds. This, for all intents and purposes, is similar but not quite to the extent of QE program being operated in the US by the Federal Reserve.

Some economists were praising Draghi for the bold move by the ECB but I wondered if these measures are too little too late. Will Eurozone get trapped into deflationary cycle like Japan? Only time will tell. Draghi today also acknowledged that the recovery is slowing but unfortunately their interest rate is at its “lower bound” thus any further easing has to come from a stronger asset buying program (QE) to hopefully inject money into the economy.

In my opinion, unless the very structure of Eurozone is changed where they have a singular fiscal and monetary policy similar to the United States, the ECB policies will be fairly impotent. Yes they will keep pushing the rate lower but they are pretty much at the bottom here and now they have to embark on rounds of QE but how effective will it be? They are not purchasing each nations government debt like what Fed is doing so I’m not sure how their QE scheme will work in pumping new money into the market. It is mind boggling how the ECB has been very accommodative in its monetary policy but the fiscal policies by its member states are practically dulling its effect. France is not helping with their sky high tax rate and Germany’s stubbornness with their austerity is laughable.

So what will be the impact of this rate cut? I am looking at EUR/CHF because as we remember, SNB pegged the Swiss Franc to the Euro at the rate of 1.20 in 2011 and today’s rate cut means EUR/CHF is now inching ever closer to that pegged level. How will SNB keep its credibility when the cost of pegging CHF is getting more expensive? Will they let the floor go? Or will they accept an even higher inflation of housing, equities, and other assets in Switzerland?

Then how about the Japanese Yen? The BOJ has been winning the race to the bottom in terms of interest rate. They have kept the 0.10% since 2010 but now that ECB has cut its rate, they are not the lowest rate in town anymore. Will BOJ look to cut their rate? Look at USD/JPY and maybe AUD/JPY or NZD/JPY for this.